TMC Stock: What's Igniting the Surge and Its Visionary Potential

The Ocean Floor: Our Next Great Frontier, Or Just Another Volatile Stock Play?

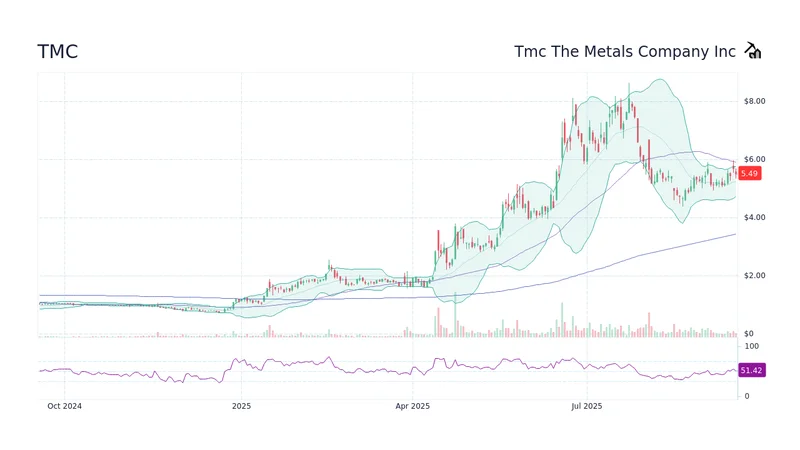

Alright, let’s talk about The Metals Company, or TMC. If you’ve been watching the markets, you’ve seen the wild ride, haven’t you? The tmc stock price has been a rollercoaster this year—up an astonishing 385% at one point, then pulling back hard, down 49% from its October highs. Just this week, after a rough November that saw a 17% dip, it shot up nearly 24% after hours. What gives? Is this just another speculative bubble, or are we witnessing the early tremors of a genuine paradigm shift for our planet’s resource future? When I first dug into the tmc stock news, I honestly just sat back in my chair, speechless, because the underlying story here is so much bigger than quarterly reports and short squeezes.

You see, this isn't just about some obscure mining operation. This is about unlocking a treasure trove of critical minerals—copper, nickel, cobalt, manganese—that are absolutely essential for the electric vehicle revolution and the massive data centers powering our AI-driven world. These aren't just industrial commodities; they're the literal building blocks of our technological tomorrow. TMC isn't digging holes in the ground; they’re looking to vacuum polymetallic nodules from the deep Pacific Ocean floor, a place most of us only ever see in documentaries. It's a frontier as daunting and promising as the moon landing was for a previous generation, and the potential impact on global supply chains and geopolitical power dynamics is, frankly, mind-boggling.

Unlocking Earth's Hidden Riches: A New Era of Resource Independence

The sheer scale of what TMC controls is staggering: an estimated $23.6 billion worth of these polymetallic rocks. Compare that to their current market cap hovering around $2 billion, and you start to see why the optimists are so bullish. It’s like owning a vast, untapped oil field in the early 20th century, but instead of black gold, it’s the gleaming metals that will fuel our green future. CFO Craig Shesky, bless his directness, made waves recently, practically daring short sellers to stick around. "Anybody who would be short the stock now," he quipped on the Rock Stock Channel podcast, "I would question what exactly is the thesis." That’s not just bravado; that’s a man who believes he’s holding a winning hand, and the after-hours surge tells you the market listened. The Metals Company (TMC) Stock Surges 24% After-Hours on CFO Comments

Now, I know what some of you are thinking: "But Dr. Thorne, what about the environmental concerns?" And you’re right to ask! This is where we, as a global community, face a profound ethical challenge. The deep ocean is a fragile ecosystem, and any extraction must be done with the utmost care and scientific rigor. This isn't a free-for-all; it's a test of our innovation, our commitment to sustainability, and our ability to balance progress with preservation. The details on how exactly this will play out, and the extent of regulatory oversight, remain a critical unknown, but I'm optimistic that human ingenuity, when properly incentivized, can rise to meet this challenge. Can we develop technologies that minimize impact, perhaps even creating new ecosystems or finding ways to restore what’s disturbed? These aren't easy questions, but they're the right ones to be asking as we stand on the precipice of this new frontier.

The political winds are clearly shifting, too. President Trump’s executive order in April, aimed at fast-tracking deep-sea mining to counter China’s control over critical minerals, isn't just a political statement; it's a strategic realignment. TMC is now in active talks with heavy hitters like the Department of Energy and the Pentagon. When national security and economic independence converge with a company’s mission, you’ve got a potent cocktail for accelerated progress. Shesky even suggested production could start before the stated Q4 2027 timeline if these regulatory roadblocks clear quickly. That’s not just an acceleration; that’s a potential slingshot for the company and for our collective ability to meet the unprecedented demand for these metals.

Yes, the company posted a net loss in Q3, and yes, the market got spooked when U.S.-China trade tensions eased, momentarily diminishing the "urgency" for alternative rare earth sources. But these are short-term blips on a much grander radar. With $115 million in cash and access to another $430 million from warrants, TMC’s financial position is stronger than it’s been since going public. This isn’t a small startup scraping by; it's a company with the runway to navigate the complex path ahead.

So, when I hear the whispers of skepticism, or read headlines about "ongoing financial losses" and "environmental uncertainty," I see something else entirely. I see the birth pangs of a new industry, a necessary evolution. It’s not unlike the early days of personal computing, where the visionaries saw a future of connected intelligence while the naysayers pointed to clunky machines and limited applications. The speed of regulatory movements and technological advancements here is just staggering—it means the gap between today and tomorrow, between dependence and independence, is closing faster than we can even comprehend, and it's exhilarating. This is the kind of breakthrough that reminds me why I got into this field in the first place, pushing the boundaries of what we thought possible. What does this mean for us, for our industries, for our children’s future? It means a chance at true resource autonomy, a critical step toward a cleaner, more electrified world.

The Deep Sea: Our Unavoidable Destiny?

The Metals Company isn't just a stock; it's a symbol of humanity's relentless drive to innovate, to explore, and to secure the resources we need for a future we can barely imagine. The volatility in the tmc stock price is merely the surface turbulence of a deeper, more powerful current. We're talking about metals that are indispensable for everything from your smartphone to grid-scale energy storage. The question isn't if we'll tap these resources, but how we'll do it responsibly and effectively. The market might be chasing short-term gains and losses, but the visionary investors, the ones looking past the quarterly noise, are seeing a fundamental shift in our resource landscape. This isn't just about mining; it’s about forging a new path for civilization, one that leads us towards a future built on abundance, independence, and the audacious spirit of discovery. It’s a complete game-changer.